How to Properly Sign a Check Over to Someone: Step-by-Step Guide for 2025

Significant transactions often involve the use of checks, and knowing how to sign a check over to someone else can facilitate seamless financial exchanges. This process, referred to as signing a check over, allows for the transfer of funds directly from one payee to another. In this comprehensive guide, we will walk you through the steps involved in the check signing process, helping you understand the intricacies involved in endorsing a check. Whether it’s a personal check or a business check, following these guidelines will ensure that you complete the endorsement correctly.

Understanding Check Endorsements

Endorsements are crucial for any check transaction. When you transfer a check, it essentially becomes a third-party check, and understanding the different types of endorsement signatures allows for proper handling. There are various forms of endorsements like **blank**, **restrictive**, and **special** endorsements, each suited for different situations. Knowing these distinctions can prevent misunderstandings when it comes to payment instructions.

Types of Endorsements

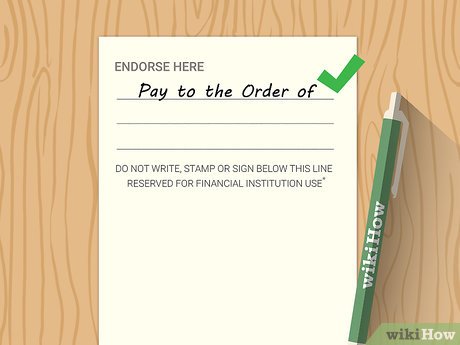

The most common type of endorsement is the **blank endorsement**, where you simply sign the back of the check. This allows anyone in possession of the check to cash it, which can be risky. A **restrictive endorsement**, however, uses the phrase “for deposit only” along with your signature, ensuring the check can only be deposited into your account—providing added security. Lastly, a **special endorsement** designates a specific person or entity as the intended recipient of the check when you write “pay to the order of” followed by the recipient’s name.

Why Check Endorsement Matters

Understanding the importance of check endorsements ensures legitimacy in financial transactions. Whenever a check is endorsed, the payor is transferring the responsibility of the check to the endorsee. This transfer involves certain rights and obligations, which are protected by banking policies. Wendy Hall, a financial educator, states that “an endorsed check not only validates the transaction but also establishes a point of accountability between parties.” Ignoring endorsement rules can lead to check fraud or disputes that could otherwise be easily avoided.

Steps for Signing Over a Check

Now that we’ve set the context, let’s explore the detailed steps required to properly endorse a check. This section details a systematic approach to signing a check over, ensuring compliance with standard check writing guidelines.

1. Identify the Payee

The first step in the process is to determine who the check is being signed over to, also known as the check recipient. This is vital when crafting the endorsement correctly to avoid unnecessary confusion. Verify that the recipient understands their rights regarding cashing a check and ensure that they have the required identification ready, as banks may ask for it during check cashing options.

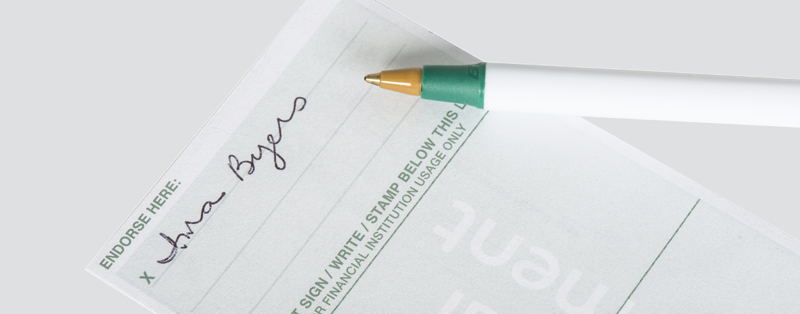

2. Sign the Back of the Check

Next, find the endorsement area on the back of the check where the signature is required. Use a pen to sign your name, just as it appears on the front of the check. For added clarity when transferring a check, you may also write “Pay to the order of” followed by the recipient’s name directly beneath your signature. This performs an essential verification function and retains clarity about the direction of the transaction as a part of the check negotiation process.

3. Additional Steps if Necessary

In some cases, especially for larger financial transactions or corporate environments, you might be required to accompany your signature with the note “For Deposit Only” or similar language. This ensures that the check can’t be easily cashed but can only be directed to an account to which it belongs. Following bank policies for checks regarding endorsements can minimize the risk associated with handling checks. Review each bank’s specific requirements as different institutions might have varying endorsement requirements.

Bank Policies and Security Measures

Every banking institution has its own set of policies and terms and conditions when it comes to handling endorsed checks. Familiarity with these policies is key to ensuring efficient check processing and compliance. Additionally, understanding how to ensure the security of checks during transfers can help prevent forged endorsements and identity theft.

Check Security Practices

When dealing with written checks, always prioritize security. Simple practices such as using colored ink, keeping checks in a secure location, and monitoring your bank statement diligently can significantly reduce the risks associated with check fraud. Avoid signing checks until needed and only sign them under secure conditions. Before handing over an endorsed check, ensure that you have clarity on how the recipient will handle it.

Understanding Bank Verification Processes

When cashing an endorsed check, most banks will implement fraud detection measures, including verification of signatures and account-related audits. It’s vital to recognize that while cashing endorsed checks can appear straightforward, it is prudent to remain aware of check cashing fees and any potential delays in funds availability. Being knowledgeable about these processes can aid in more informed financial decision-making.

Best Practices for Check Endorsement

Implementing best practices in endorsing checks is essential for maintaining integrity and safety in financial transactions. Here we will elaborate on numerous guidelines that can help maintain a seamless flow and avoid potential pitfalls.

Documentation and Record Keeping

Always keep a detailed record of checks that have been written or signed over. This can help in tracing back transactions if disputes arise. Taking digital pictures of endorsed checks or keeping physical copies can serve as a robust source of verification when resolving discrepancies. Be sure to document the recipient’s information and ensure the endorsement is performed in a secure manner always.

Educating about Check Handling and Risks

In a fast-paced financial environment, it is essential to remain aware of risks associated with writing and endorsing checks. Regular education on procedures for accepting checks and cashing endorsed checks can aid individuals in avoiding common mistakes. It is wise to stay updated with ongoing policy changes regarding banking practices, which might include digital endorsements in the context of modern banking.

Key Takeaways

- Understanding the types of endorsements is vital for properly transferring checks.

- Always ensure clarity in signing checks over to the correct recipients.

- Implement security practices to reduce the risk of fraud.

- Familiarize yourself with your bank’s policies for check endorsement.

- Document transactions and educate yourself on best practices for check handling.

FAQ

1. Can I endorse a check to someone who is not my relative?

Yes, you can endorse a check to anyone as long as you follow the proper procedures for signing it over. Make sure you comply with your bank’s policies for endorsing a third-party check.

2. What if my signature does not match the one on the check?

If your signature differs from the one on the check, it may raise flags during the check verification process, delaying cashing. Always use the signatory name that appears on the front, or talk to your bank about your requirements for signature verification.

3. How does the security of checks get enforced at banks?

Banks use various security measures, including signature verification, to authenticate checks. These measures are essential in preventing fraud and ensuring transactions legitimacy.

4. What happens if an endorsed check is lost?

If an endorsed check is lost, the endorsed party may need to request a stop-payment through the issuer’s bank while confirming the status. They might also need to issue a new check or follow specific procedures mandated by the bank.

5. Are there limitations on the amount endorsed checks can be?

Generally, there are no explicit limitations on the amount; however, banks may impose check cashing regulations depending on the amount. Larger sums may necessitate additional identity verification.

6. Can I write “for deposit only” when endorsing a check?

Yes, writing “for deposit only” along with your signature on the back of a check is a good way to restrict how the check can be used and provide additional protection against fraud.

7. Are there fees associated with endorsing a check at banks?

Some banks may charge check cashing fees for endorsed checks, particularly if the cashing is done at a location where you do not hold an account. Always inquire about policies before proceeding.