Essential Guide to Chapter 7 Filing Costs in 2025: What You Need to Know

Navigating the world of bankruptcy can be daunting, especially when it comes to understanding the financial obligations involved in filing for Chapter 7. In this guide, we’ll break down the costs associated with Chapter 7 bankruptcy in 2025, including attorney fees for Chapter 7, filing fees for Chapter 7, and other pertinent expenses, providing you with a comprehensive overview of what to expect, along with practical tips for managing these costs.

Understanding Chapter 7 Bankruptcy Expenses

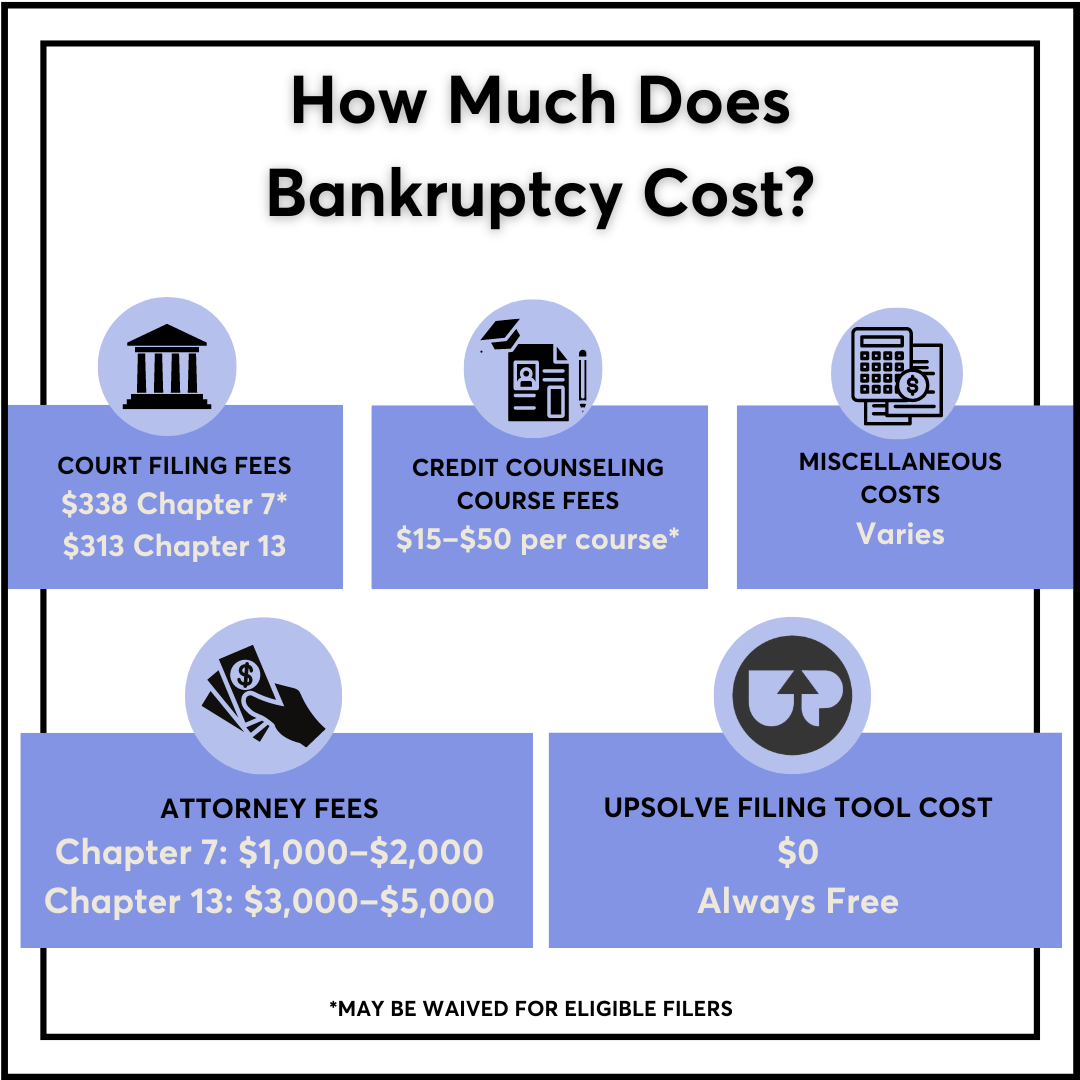

When considering bankruptcy, it’s essential to have a clear picture of the total cost of Chapter 7 filing. This encompasses not just attorney fees but also various court-related charges and mandatory pre-filing consultations. Understanding these Chapter 7 bankruptcy fees is key to planning your financial recovery. Typically, the structure of Chapter 7 costs includes three major components: the filing fee, attorney fees, and additional costs incurred during the bankruptcy process.

Breakdown of Chapter 7 Filing Fees

The filing fee for Chapter 7 in 2025 is expected to remain consistent, generally around $335, which is required at the time of filing your petition. In addition to the filing fee, you might encounter bankruptcy court fees for various services that enhance your chances of a successful outcome. These might include fees for credit counseling sessions and process serving. If you find it difficult to manage these costs, you may discuss a fee waiver with the court or explore setting up an installment payment plan, depending on your specific circumstances.

Attorney Fees for Chapter 7

The cost to hire a bankruptcy attorney varies widely based on their expertise and your location. On average, the standard Chapter 7 cost for legal representation can range from $1,500 to $3,500 or more. Hiring an experienced attorney may seem costly, but their guidance can be invaluable in navigating the Chapter 7 filing process. It’s advisable to seek recommendations or read client testimonials to find an affordable Chapter 7 filing that suits your needs.

Additional Costs to Consider

Beyond the basic filing and attorney fees, there are other costs associated with filing for Chapter 7 bankruptcy. These include costs for necessary financial literacy courses and potential fees for obtaining required documentation. Being prepared with a cost breakdown for Chapter 7 can help you allocate your resources wisely and avoid unexpected financial strain throughout the process.

Pre-Filing Requirements and Counseling Costs

Before you can officially file for bankruptcy, you are required to attend a credit counseling session. This is a crucial step in the consumer bankruptcy process and helps you understand your financial situation better. It’s often coupled with a fee, although some nonprofit organizations offer this service at no cost.

Credit Counseling Requirements

The credit counseling requirement involves a course designed to assess your financial health and explore alternatives to bankruptcy. These sessions usually last a few hours and cost anywhere from $20 to $100. Completing this step prior to filing is essential, as failure to do so can result in your case being dismissed. Understanding this prior step helps in comprehending the overall bankruptcy filing costs.

Documentation and Preparation Costs

Preparing for bankruptcy can involve additional costs related to gathering documentation, like tax returns, bank statements, and proof of income. If you choose to rely on an attorney, they may charge extra for bankruptcy petition preparation, hence understanding the chapter 7 application costs helps streamline this part of your process.

Exemptions and Their Impact on Costs

Understanding exemptions in Chapter 7 is vital for maintaining certain assets while still undergoing bankruptcy. Legal advice focusing on your specific situation can provide clarity on which properties you can exempt, potentially affecting your overall costs or fees. Using a bankruptcy attorney who can explain these intricacies will not only assist in cost management but also ensure you make informed decisions.

Filing for Chapter 7 Without an Attorney

While many choose to hire an attorney for the complexities of filing for Chapter 7 bankruptcy, it is entirely possible to navigate the process independently. However, this route requires careful preparation and a thorough understanding of the bankruptcy court procedures.

Self-Representation: Pros and Cons

Filing Chapter 7 without an attorney may save you money regarding legal fees Chapter 7, but it bears a unique set of challenges. The potential pitfalls include misfiling important documents or missing statutory deadlines, both of which could postpone your case or lead to dismissal. Therefore, if you decide on self-representation, consider seeking minimal legal counsel for a pre-filing consultation.

Costs Involved in Self-Filing

When navigating the costs involved in filing Chapter 7 without attorney assistance, you still need to account for the costs of filing and counseling. Be sure to invest adequately in understanding the necessary paperwork and court interactions to maintain a definitive grasp of these requirements.

Managing Expectations During the Process

Successfully filing for bankruptcy entails navigating various timelines and anticipating potential costs at different stages. Understanding your particular requirements and being familiar with the chapter 7 timeline will help mitigate surprises during the process. This foresight into the timing and costs around bankruptcy expenses will ensure a smoother transition into your financial recovery.

Key Takeaways

- Understand the total costs, including attorney and court fees, involved in Chapter 7 filing.

- Plan for additional expenses, including counseling fees and documentation preparation.

- Consider your options between self-representation or hiring a bankruptcy attorney.

- Be aware of the requirements to successfully file, including credit counseling and exemptions.

- Keep track of the Chapter 7 timeline to navigate the process effectively.

FAQ

1. What is the expected Chapter 7 costs breakdown?

The expected Chapter 7 costs typically include a filing fee of approximately $335, attorney fees ranging from $1,500 to $3,500, and additional expenses like credit counseling fees. Individuals may incur costs related to obtaining documentation as well, which can vary widely based on what documents are needed for submission.

2. Are there alternatives to filing for Chapter 7 bankruptcy?

Yes, there are alternatives to filing for Chapter 7 bankruptcy. Some options include debt management programs, credit counseling, or potentially considering Chapter 13 bankruptcy; this can provide a way to restructure debts. Consulting with a financial advisor can help you find the best path based on your circumstances.

3. What are the common misconceptions about filing for Chapter 7?

One common misconception is that all debts are eliminated through Chapter 7 filing; however, non-dischargeable debts such as student loans, taxes, and certain court judgments may still remain. Understanding the implications of filing is crucial before proceeding.

4. How long does the Chapter 7 process take?

The duration of the Chapter 7 process can vary but typically lasts between 3 to 6 months from the time of filing to discharge. Several factors can affect the timeline, including the nature of debts and the efficiency of documentation submission.

5. Can I file for Chapter 7 on my own?

Yes, it’s possible to file for Chapter 7 without an attorney, yet it’s generally advisable to seek guidance. This can help ensure successful document handling, compliance with court procedures, and avoidance of common pitfalls that may delay your process.

6. How do attorney fees affect the total cost of Chapter 7?

Attorney fees are one of the most significant expenses in the overall cost of Chapter 7 bankruptcy. These fees can vary based on experience and geographical location, and choosing an experienced attorney can lead to a smoother process, potentially saving you money in the long run.