How to Effectively Remove Paid Collections from Your Credit Report in 2025

When dealing with the intricacies of credit management, understanding how to remove paid collections from your credit report is crucial for improving your financial standing. Paid collection accounts can still linger on your credit history, impacting your credit score recovery efforts. Let’s explore actionable strategies and helpful insights to achieve effective credit report removal of these adversities.

The Impact of Paid Collections on Your Credit Score

Paid collections, while viewed as lesser issues than unpaid debts, can still significantly threaten your credit score recovery. Although you have settled the collection, these accounts remain reported on your credit file for up to seven years. This residual effect can lead to a decreased creditworthiness assessment, reducing opportunities for obtaining loans or favorable interest rates. Consequently, managing the implications of these entries is vital to ensure your financial goals align with your credit history.

Understanding How Collections Impact Your Credit

The impact of paid collections on your credit score is more profound than many realize. Even when an account is marked as paid, it can still influence five critical factors that determine your score: payment history, amounts owed, length of credit history, new credit inquiries, and credit mix. For instance, a paid collection reinforces negative payment history, an area that constitutes about 35% of your FICO score. Therefore, understanding this relationship is pivotal to leveraging strategies that lead to successful credit repair.

Effects of Collections on Future Credit Applications

When applying for new credit, lenders often consider your total credit report, measuring your risk level. A history of paid collections can limit options, increase interest rates, or even lead to denial. Post-collection credit challenges may necessitate proactive steps such as debt negotiation strategies or exploring credit restoration services to address lingering issues with creditors. Recognizing that these paid collections still hold weight is essential for navigating future lending landscapes.

Strategies for Minimizing the Impact of Collections

Reducing the impact of collections starts with proactive measures. Consider a pay for delete agreement, which can lead to the removal of a collection account from your credit report in exchange for payment. Additionally, understanding consumer protections under the Fair Credit Reporting Act empowers you to dispute inaccuracies and negotiate timelines directly with collectors, enhancing the accuracy of your credit file.

Steps to Successfully Remove Paid Collections

The journey to eliminate paid collections from your credit report involves a systematic approach. Here are actionable tips to enhance your chances of success, focusing on tools and procedures that can positively influence your financial standing.

Utilizing the Dispute Process

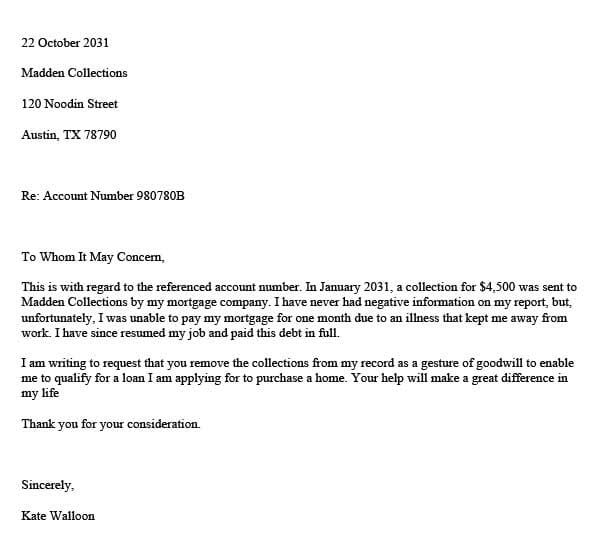

Engaging in the dispute process is one of the most effective ways to remove paid collections. Begin by checking the accuracy of information reported to the credit bureaus. If an error appears—be it an incorrect total balance or a collector that no longer owns the debt—file a dispute with the bureaus. Prepare a clear and concise letter to remove collections that outlines your reason for disputing the item while including any supporting documents that validate your claim. This clear request for correction can yield favorable outcomes.

Understanding Your Legal Rights for Debt

Familiarize yourself with consumer protection laws that dictate how debts should be reported and how collection agencies must conduct their business. If you discover any violations in the reported collections, you can raise a dispute grounded in the adherence of the credit bureau and the debt collector’s procedural oversight. This understanding is instrumental in negotiating collections effectively and may bolster the other necessary processes to clean your credit report.

Implementing a Credit Monitoring System

Leveraging credit report monitoring services can aid in this process. Observing updates provides insight into any changes regarding your credit report. These systems can alert you to inaccuracies or new entries, allowing for immediate dispute initiation, which protects your credit history against inaccuracies. Regularly reviewing your credit report enables you to track progress and ensure all paid and settled accounts reflect accurately.

Negotiate Collections and Settlement Options

Another effective method for dealing with paid collections lies in the negotiation and settlement options within your debt management plan. Negotiate directly with your creditors, and be prepared to discuss feasible payment methods that may lead to forgiving collection entries.

Negotiating Settlement Debts

Consider approaching debt collectors with a realistic settlement offer. Be mindful to articulate your intent clearly regarding the account you wish to settle before formally starting any discussions. Negotiation can manifest in an agreement where you pay a portion of what you owe; in exchange, the collector agrees to remove the collection from your report. A well-crafted deal related to the settlement negotiation tactics often provides a win-win solution for both parties.

Implementing a Pay-For-Delete Agreement

As mentioned, a pay-for-delete agreement serves as an efficient credit improvement strategy. This agreement stipulates that upon payment or settlement, the creditor shall remove mention of the collection account from your credit report. Outline all terms clearly in writing to establish accountability and prevent future demonstration of the collection in queries for your credit history management.

Common Mistakes to Avoid in Credit Repair

While pursuing the removal of paid collections, it’s crucial to avoid common pitfalls that can hinder your progress. Here are strategies to ensure you are on the correct path.

Avoiding Collection Agency Tactics

**Understanding collection agency tactics** can help prevent repercussions in your future financial dealings. Often, debt collectors utilize demanding tactics to facilitate prompt payments; however, being aware empowers you with knowledge to resist pressure tactics. Recognize that you have rights, and if communications become overly aggressive, consider seeking legal advice from consumer protection organizations.

Managing Collection Account Disputes Effectively

Understanding how to appropriately handle any collection account disputes is paramount. Avoid emotional responses or agreements made in haste; rather, pause and evaluate your options. If pursued inappropriately, you may inadvertently solidify an adverse resolution instead of effectively managing these circumstances. Establish a calm approach, emphasizing documentation and clarity in your negotiations.

Consulting Credit Repair Specialists

Sometimes, hiring reputable credit repair companies can expedite your efforts in reversing detrimental reports. These experts understand the nuances of credit repair strategies and can guide you through disputing inaccuracies, handling collections, and improving your overall credit score. Informing yourself about credentialed services can significantly enhance your efforts in overcoming credit challenges.

Key Takeaways

- Assess the implications of paid collections on your credit score and future applications.

- Use a mixture of dispute processes and negotiations to effectively target paid collections.

- Understand your rights and avoid common pitfalls in credit repair efforts.

- Consider professional assistance to navigate complex disputes and legal nuances.

- Regular monitoring of your credit report can provide vital insights for improvement.

FAQ

1. How long do paid collections remain on my credit report?

Paid collections typically remain on your credit report for seven years from the date of the original delinquency, even after settling the debt. This retention can impact your credit report accuracy and overall score but is generally less impactful over time.

2. Can I negotiate with a collection agency to remove a paid collection?

Yes, negotiating with a collection agency is often feasible. You can propose a pay for delete agreement, where you agree to pay the debt in exchange for the agency removing the collection from your report.

3. What is a credit report dispute process?

The credit report dispute process involves reviewing your credit report, identifying inaccuracies, and contacting the credit bureau to file a dispute accompanied by documentation supporting your claim. This method can lead to a corrected credit history.

4. Are collection accounts still harmful if they are paid?

Paid collection accounts may still negatively affect your credit score as they can indicate a history of missed payments. However, their impact generally decreases as time passes, especially if you demonstrate positive financial behaviors thereafter.

5. How can I monitor my credit report effectively?

You can utilize credit monitoring services to keep track of changes on your credit report. These services offer notifications for any updates, providing you an opportunity to address inaccuracies promptly and maintain a healthy credit profile.

Through understanding effective strategies, knowledge of rights, and diligence in your approach, you can work towards successfully removing paid collections and bolstering your financial future.