Effective Guide to How to Make an ACH Payment

Understanding the ACH Payment Process

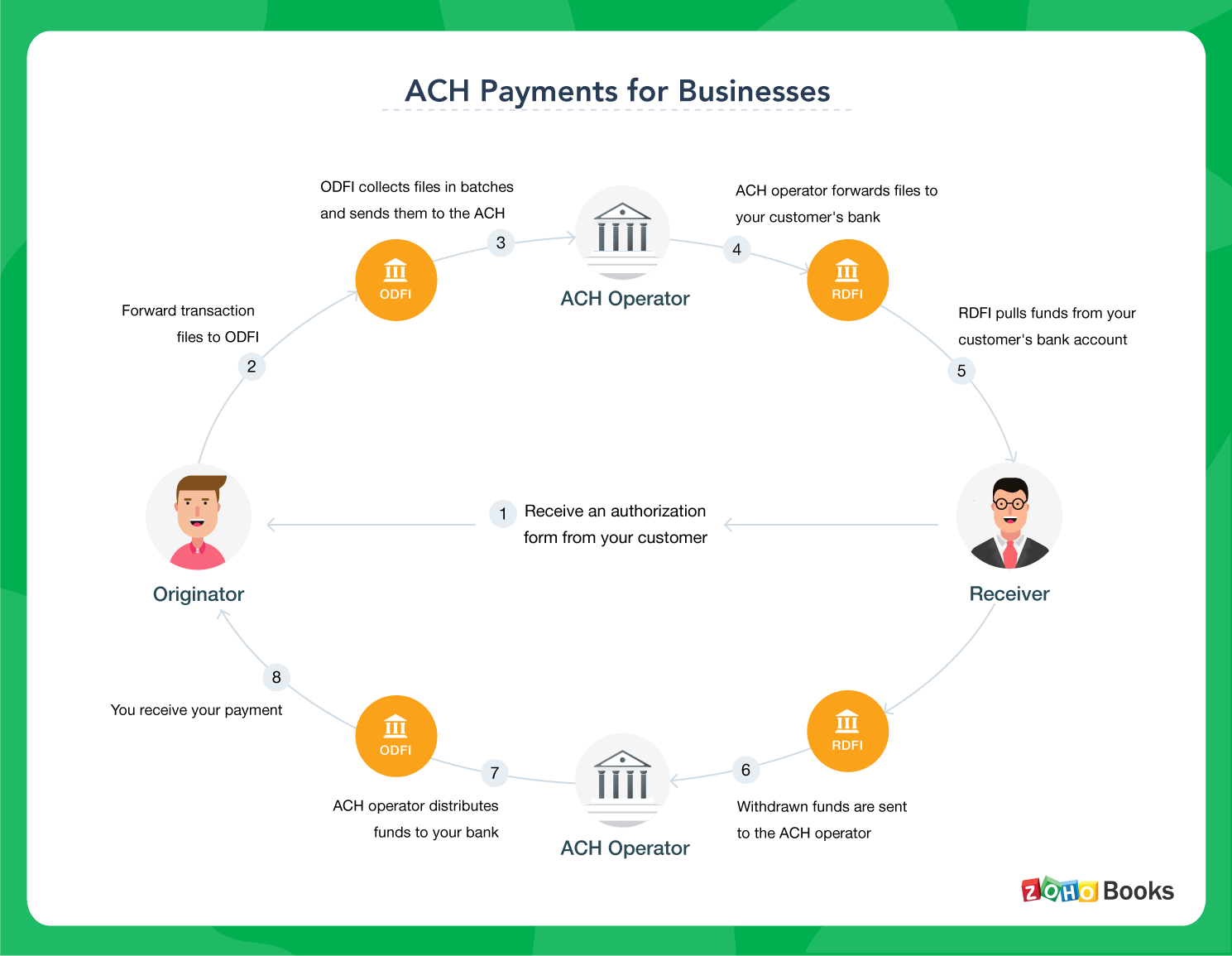

To navigate the digital landscape of payments in 2025, understanding the **ACH payment process** is essential. ACH, or Automated Clearing House, is a financial network allowing businesses and consumers to process electronic payments securely. One of the primary appeals of ACH payments is their speed and cost-effectiveness compared to traditional check methods. An **ACH payment setup** typically involves a few straightforward steps: gathering bank details of the sender and receiver, obtaining requisite authorizations, and initiating the transaction. Each component plays a critical role in ensuring that payments occur efficiently and securely, enabling faster transactions that are automatically processed between accounts. By utilizing this system, both consumers and businesses can enjoy enhanced **ACH payment benefits**, such as reduced transaction costs and error-free payments.

Key Components of ACH Transactions

A thorough comprehension of how to make ACH payments involves understanding its major components. Central to this process is the **automatic clearing house** network, which facilitates the electronic movement of funds between banks. After a user sets up ACH payment services, each transaction requires proper **ACH payment authorization**, which ensures the legitimacy of payments, reducing the likelihood of fraud associated with unauthorized transactions. Additionally, awareness of various **ACH payment types**—including credit and debit transactions—can aid in selecting options best suited for specific requirements, such as payroll processing or bill payments. Therefore, learning the intricacies of ACH transaction intricacies establishes a solid foundation for leveraging this payment method effectively.

How ACH Payments Work for Consumers

Understanding how ACH payments work can enhance consumer experiences while automating payments. Consumers generally initiate transactions, such as ACH direct deposits, by providing their bank account information to service providers. This step allows users to authorize transactions conveniently with either a one-time or recurring schedule. Utilizing electronic funds transfer capabilities, the funds are then approved for transfer and processed through the ACH network. Keeping track of these **ACH payment transactions** is equally essential. Using **ACH payment tracking** methods like transaction history can provide insights into funds flow, allowing users to address any anomalies promptly. Notably, users must also comprehend the **ACH payment deadlines** to ensure timely processing of transfers. Understanding these basics can significantly streamline personal financial management.

Navigating ACH Payment Setup

Setting up **ACH payments** can be a straightforward yet essential task for businesses aiming to improve cash flow and efficiency. Business owners should prioritize a solid **ACH payment management** strategy that outlines the step-by-step procedures necessary to accomplish the setup. These steps typically involve choosing the appropriate **ACH payment provider** that aligns with the unique needs of the business, which might include software capabilities and transaction fees. The right provider will enable businesses to manage their transactions seamlessly, optimizing workflows and reducing overhead associated with traditional payment methods. By establishing a solid foundation, organizations can leverage ACH payments effectively to cater to customer needs.

Steps to Set Up ACH Payments

The first step in the **ACH payment setup** is gathering the relevant bank information required for transactions, which includes account names, numbers, and routing information. Afterward, you can integrate this data into your chosen payment system, whether it’s a standalone software solution or part of a more extensive payment processing platform. During this phase, obtaining written **ACH payment authorization** from customers is essential, ensuring they consent to the payment process. After following these crucial steps, businesses must engage in proper training regarding the ACH payment workflow among staff, establishing procedures for **ACH payment tracking** and records maintenance. This proactive approach will facilitate ongoing compliance with established regulations while guaranteeing smooth payment experiences.

Understanding ACH Payment Integration

The integration of **ACH payment systems** into existing business frameworks is crucial for optimizing efficiency. Businesses must evaluate various **ACH payment tools** and technologies to secure smart integration while adhering to compliance regulations. Integrating ACH with financial software can eliminate manual efforts, streamline processes, and enhance overall payment experience. This integration can sometimes include APIs offered by various **ACH payment providers**, allowing for fluid transaction capabilities across multiple platforms. Different implementation strategies may accommodate diverse operational structures, but ultimately, ensuring **ACH payment security** and efficient systems should remain a priority. Effective ACH payment integration not only promotes operational efficiency but also enhances the customer payment experience dramatically.

Common Challenges with ACH Payments

Though having an ACH payment system is efficient, businesses can encounter various issues during proactive management. Challenges such as **ACH payment reconciliation** can arise when companies face discrepancies between statement records and system data. This discrepancy can lead to confusion over the accuracy of transactions and could harm both financial reporting and customer relations. Understanding **ACH payment limitations** is crucial as certain transactions may exceed tradable boundaries or face restrictions during processing. Therefore, recognizing the facets of ACH payment compliance ensures businesses align with current financial regulations while firmly managing these challenges effectively.

Tips for Troubleshooting ACH Payments

To navigate common challenges in ACH payments, businesses should implement a systematic approach to troubleshooting. **ACH payment tracking** mechanisms must be in place to monitor transaction statuses actively. Regular audits can unveil discrepancies allowing businesses to detect issues during the **ACH payment lifecycle** swiftly. Additionally, employing automated alerts for transaction failures or confirmation will streamline operational efficiency. Understanding the **ACH payment dispute resolution** process can also enhance communication with financial institutions, minimizing delays in payment processing times. Staying informed about potential risks associated with ACH payments, such as unauthorized transactions, can also empower businesses to implement protective measures. Companies can thereby ensure smoother and more reliable financial operations.

Exploring ACH Payment Security Measures

Security stands at the forefront when making ACH payments. Implementing robust **ACH payment security** protocols and leveraging encryption technologies helps in safeguarding transaction data during transfers. Another primary concern is **ACH fraud**, which could disrupt business transactions and financial standing. Businesses should invest in security measures to enforce authenticated ACH payments actively, conducting due diligence and periodically reviewing transactional data. Using advanced software that tracks user behavior and flags unusual activities enables organizations to act swiftly against potential malicious attempts. By prioritizing security, businesses can harness ACH payments’ benefits without compromising the integrity of their financial operations.

Conclusion

Initiating **ACH payments** presents a myriad of advantages for businesses and consumers. As we embrace the digital age entering 2025, understanding the intricacies of the **ACH payment process** will remain imperative. From establishing clear **ACH payment instructions** to integrating secure and efficient payment solutions, companies must navigate these dynamics effectively. Preparedness and adaptability in the swiftly evolving payment ecosystem will tremendously benefit organizations, ensuring they remain a step ahead. Getting started with ACH means embracing an innovative way to facilitate faster transactions, reduce fees, and create a seamless transaction experience.

FAQ

1. What are the main types of ACH Payments?

ACH payments come in two primary types: ACH credits and ACH debits. ACH credits allow businesses to send money to a client’s account, often utilized for practices such as payroll processing and vendor payments. Conversely, ACH debits authorize businesses or service providers to collect payment directly from a customer’s account, useful for subscriptions or utility billings. Exploring each type can help determine the most effective configuration for your business needs.

2. How can I verify ACH payment information securely?

Verifying **ACH payment information** involves ensuring the accuracy of bank details provided by both parties involved. Employing software systems that authenticate transactions and using confirmation notifications can further bolster security. Businesses should also encourage customers to use correct routing and account numbers to avoid errors during payment initiation. Oftentimes, having designated personnel in charge of monitoring payment information can significantly reduce the risks of errors.

3. What are common issues faced during ACH payment processing?

Common issues in ACH payment processing may include incorrect bank details, processing delays, and discrepancies in transaction records. Such challenges can lead to unsuccessful transactions, resulting in potential financial losses. Companies can mitigate these risks by ensuring clear communication and setting realistic **ACH payment deadlines**, so customers know when payments are processed and expected.

4. How do ACH payments compare to wire transfers?

When examining **ACH vs wire transfers**, key differences emerge. Wire transfers offer real-time processing, usually costing more, while ACH transfers are slower with lower fees. Additionally, wire transfers provide instantaneous payments across bank networks and are commonly used for international transactions. Alternatively, ACH payments are well-suited for periodic payments and are more affordable, making them ideal for routine business transactions.

5. What steps can I take to enhance ACH payment security?

To enhance ACH payment security, businesses should implement multifactor authentication, regularly monitor bank transaction statements, and utilize encryption technologies for transferring sensitive information. Training employees on recognizing fraudulent attempts and employing comprehensive audits can also improve overall security. Establishing clear protocols along these lines ensures both enterprises and customers remain protected during electronic transactions.